Winning Streak

By Haris Zamir | Economy | Published 7 years ago

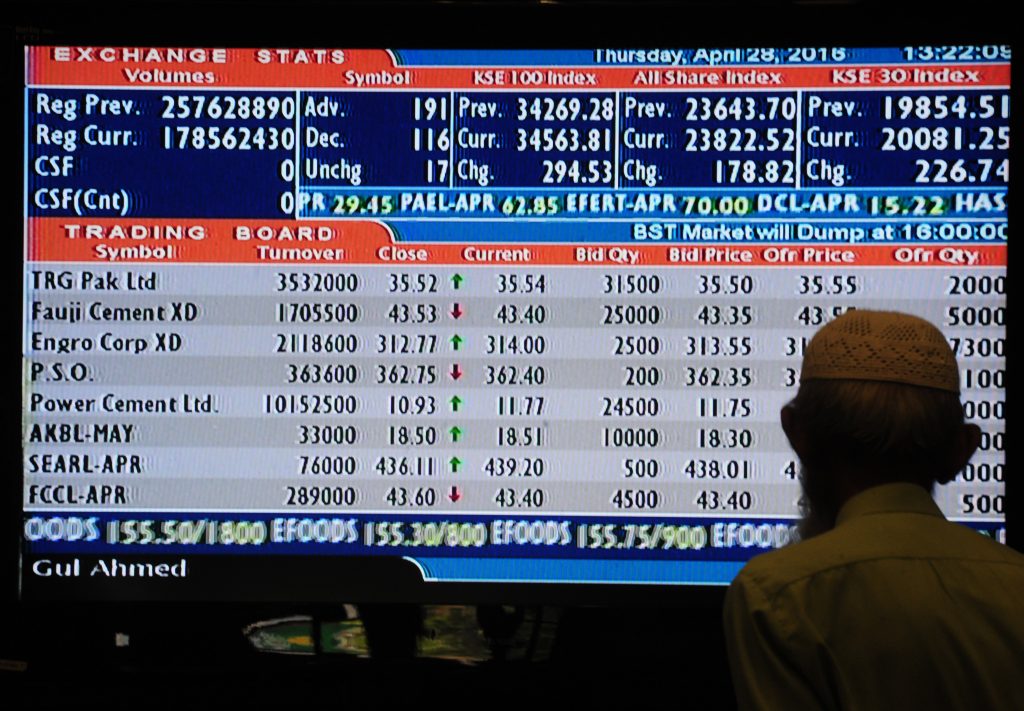

The Pakistan Stock Exchange (PSE) broke records in world financial markets in 2016. Starting on a high of 32,000 points, it scored a gain of more than 15,000 points to end the year at over 47,000 points. Another major achievement was the sale of around 40 per cent shares of the bourse to the foreign stock market, with China stepping in to take over key entities.

The selling of shares to the Chinese group comprising China Financial Futures Exchange Company, Shanghai Stock Exchange, Shenzhen Stock Futures and two financial institutions, Pak China Investment Company and Habib Bank Limited, yielded 85 million dollars. The Pakistan Stock Exchange was valued at 76 million dollars before the group bid of Rs 28 per share, while the value has now jumped to 212 million dollars.

The Pakistan Stock Market (PSX) was christened in January 2016, after merging the Karachi, Lahore and Islamabad Stock Exchanges. Forty per cent stakes were then offered for sale to foreign and local institutions and 20 per cent to the general public, while 40 per cent shares were retained by the stockbrokers.

It was estimated that the transaction would range between Rs 21 billion and Rs 26 billion and that nearly half of the proceeds from the deal would be redeployed into the stock market, which would generate another rally. Analysts and brokers predict that the index might touch a ceiling of 60,000 points by 2017.

There is, however, some skepticism about recent dealings with the Chinese, with some analysts saying that our decision-makers seem to be putting all their eggs in one basket. A global economic slump or meltdown — with China being the largest business partner in the world — would thus be a bigger blow to Pakistan, compared to earlier slumps in global financial markets. Debt, too, would rise; it already stands at a whopping 74 billion dollars. After the inclusion of domestic debt, every Pakistani has been burdened by around Rs 124,000 in debt. Before the arrival of this business-friendly government, the debt was in five figures.

The start of 2016 was a bit bumpy for business and Pakistan Tehreek-e-Insaf’s raising of the Panama Gate issue made some dents in the market. But measures taken by the present government overtook developments on the political front, as the three-year IMF funding programme worth 6.6 billion dollars was successfully completed. Moreover, the performance of Pakistani economy and stock market was appreciated worldwide, with major financial dailies and periodicals publishing favourable articles. Zarb-e-Azab and the fight against terrorism also generated good coverage and served to build up investor confidence. Moreover, investors’ wounds were healed after calm finally prevailed in Karachi, the country’s financial hub. Appreciation from the business community sent positive signals to local investors. The economy recorded a growth of 4.7 per cent in the fiscal year ended June 30, 2016, the third consecutive year showing growth above 4 per cent. During the Zardari government, the economy showed an average growth of 3 per cent.

Moreover, the Asian Development Bank, World Bank and the International Monetary Fund reports spelled out efforts taken by the present government to put the economy back on track, like broadening the tax base, reducing the fiscal deficit, curtailing the current deficit and adopting measures to streamline public entities. The government failed, however, to make sufficient headway with public sector reform, with losses going unchecked at Pakistan International Airlines, Pakistan Steel Mills and Pakistan Railways. Low interest rates, a market flush with liquidity and low inflation rates continued to encourage local investors to make a beeline for the local stock market.ewaaqsda

Local mutual funds, financial institutions, high net worth individuals and banks led the market, which helped enable foreign selling in excess of 260 million dollars during the period. Local investors also poured in nearly 450 million dollars into the market. Cheaper interest rates diverted institutional funds to the market, as the return on long-term and short-term bonds was quite low, while earnings from the share market were in the range of 15 to 20 per cent.

Local investors were broadly bullish because of China Pakistan Economic Corridor-related developments as China assured investment of more than 46 billion dollars in power, roads, motorways and water reservoirs. They have confirmed their interest in buying the K-Electric Company worth 1.7

billion dollars through Shanghai Electric. Some Chinese companies have shown interest in buying dormant cement companies, while a few power producing companies are planning to install coal-run power plants through local partners. Above all, they will be buying stakes in the Pakistan Stock Market.

Analysts and brokers also gained confidence after the renowned Morgan Stanley Capital International (MSCI) decided to include the Pakistan Stock Market in their list of emerging markets. The bourse will be placed physically on the chart from March 2017 onwards. This is a good omen for market observers and investors as the inclusion would initiate foreign investment in the equity market, holding out a message of good returns to offshore institutions. This should bring in another 300 million dollars to 400 million dollars in fresh investment from foreign fund houses, helping the index to remain upbeat.

Zeeshan Afzal, director research at Insight Securities, says 2017 looks favourable for Pakistan Equities, as the MSCI reclassification has added value to the already built investment theme, based upon political stability, macroeconomic strength, an improved security situation and Chinese investment. PSX divestment further swells the enthusiasm, to result in better liquidity, new products and investor confidence.

The recent 16 per cent gains over 32 trading days provides a glimpse of the level of confidence and liquidity gush. However, one should keep an eye on any deviation from the reform process, imported inflation, local currency movement and the interest rate outlook.

“With positive news flows all around and projected fund inflows, market price multiples re-rating towards its justified levels would be inevitable in 2017. However, how much KSE 100 would re-rate is a burning question,” Afzal elaborates.

Taha Khan Javed, director research at Alfalah Securities, said liquidity at brokerage companies is set to increase as the sell-off of Pakistan Stock Exchange shares, expected by the middle of 2017 should harvest Rs 67 million per broker, which will increase liquidity.

“We are more bullish on long-term prospects, as having an international operator will provide much needed technological improvement and greatly improve the perception of PSX in world markets. We are especially excited about the launch of new derivative products and possible cross-listings, which will likely add much needed depth to the current predominantly cash-based market,” remarked Javed.

Nadeem Naqvi, Managing Director, Pakistan Stock Exchange, gave an exclusive interview to Newsline about developments at PSX, including the selling of shares to foreign investors — and the benefit investors, the market, and the country could expect from this landmark deal.

Can you elaborate on the process of merging Karachi, Lahore and Islamabad stock exchanges into one entity — the Pakistan Stock Exchange?

I think the genesis of the journey to sell 40 per cent strategic shares started in August 2012 with the signing of the demutualisation, corporatisation and integration act of stock exchanges — Act 2012 — which was to bring about improved governance, transparency and professionalism in the operation of stock exchanges of Pakistan and prepare them for partnership with international investors. I am happy to say that we have covered all those milestones.

How would we improve the quality of the stock exchange through this transition?

The ground work was done to develop new products, technology upgradation and improved service, to make the stock exchange more attractive to potential investors. Another part of this transition was the marketing of the exchange to investors and companies, to increase listing.

We created a regulatory department whereby brokers, market participants and companies would all be under compliance with the regulatory framework. Concurrently, the stock exchange board was reconstituted, whereby six directors were nominated by the Securities Exchange Commission of Pakistan (SECP), while four represented the brokers’ community. Moreover, the appointment of the managing director was made with the consent of the stock market regulator.

Why were shares of the stock market sold to foreign investors and not to local institutions like banks, mutual funds etc?

The purpose of inviting the interest of foreign investors and international exchanges combined with local institutions was to massively increase the investor base, which is at present only 0.2 per cent in Pakistan versus almost 2 per cent in India and about 6 per cent in Bangladesh despite lower per capita income.

We wanted to make Pakistan an attractive destination for foreign investors and to improve the possibility of Pakistan-based companies raising capital from international markets. Another important objective was to increase liquidity by introducing derivatives such as futures options and exchange trade funds which are not present in our market.

Has China expressed an interest in acquiring a strategic stake because of CPEC?

A total of 17 expressions of interest were received to buy out stakes in the Exchange; of this nine arrived from foreign institutions while eight were locals. One withdrew, while names of 16 companies were forwarded to SECP. So, in my view, there is a range of foreign investment and interest, not just China, but entities from Europe and North America also poured in.

It may be noted that one year ago, the Turkey, Qatar and London Exchanges had also shown interest but due to a variety of reasons these proposals did not reach a concrete level.

At the same time, the interest by a Chinese consortium made a lot of sense as they could facilitate equity and debt funding for joint venture projects under CPEC.

Will the price be Rs 28 per share for the general public to buy 20 per cent shares in PSX and when is the IPO expected?

I cannot comment on the pricing because it is for the shareholders and the SECP to decide at what price they will sell the remaining shares, but I am sure the IPO is expected some time in 2017.

What benefits will the Pakistan economy reap through the PSX sell-off?

Stock market performance is typically linked to the corporate sector performance, which in turn is linked with the country’s economy track. There is a linkage as far as strategic investment by the Chinese consortium is concerned and it would benefit Pakistan’s economy by linking up to a new foreign investor base in China, where the size of the investor base is 200 million people. It will also facilitate capital formation in the domestic economy by partially funding CPEC and other related infrastructure projects at the PSE, which would enhance the number of securities and broaden investment opportunities for domestic investors.

In the long run, there is also a possibility that once the Chinese investors understand the dynamics of the local corporate sector, they can help inject fresh capital from the Chinese capital market as well as explore cross-border listing.

Do you think, a new set-up would attract fresh listing following the selling of stakes at the Pakistan Stock Exchange?

Initial Public Offering or IPO, (selling of shares by a company through the stock market), activity was globally subdued during the 2008 financial crisis, and Pakistan was not alone in witnessing a sharp reduction in IPOs. The Exchange made a continuous effort to create awareness about the benefits of listing for private companies and family-held businesses.

In FY 2015, all this effort translated into nine IPOs of both equity and debt and almost all of them had a very good price performance from the date of listing, ranging from 30 per cent to over 100 per cent appreciation in share price.

In FY 2016, there was an incident whereby certain government agencies initiated an investigation against financial advisors and brokers regarding an IPO that had taken place in 2010. As a result, both leading investment banks, as well as financial advisors and companies who were planning to get listed, stepped back.

SECP moved in a positive manner and convinced the government to have a bill passed in parliament whereby any action against capital market participants would not be initiated by government agencies without SECP consent, as is the case with banks, where the State Bank of Pakistan’s nod is required.

This is a welcome step, but the damage to market participants was done. It is important for policy makers at the government level to understand that it takes a long time to build market/investor confidence and a single mistake or ad hoc action can shatter the entire credibility of the market, which then takes a long time to rebuild.

Nevertheless, in my assessment related to CPEC, especially in the energy sector, over the next two to three years up to one billion dollars worth of new listings would be expected at the exchange, sending a positive message to local companies as well.